Why ATM fees are still at record highs, and what journalists should know

By Molly McCluskey

In an age of digital banking and emerging virtual currencies, automatic teller machines (ATM) seem an almost antiquated technology. Concerns about the safety of cash during the pandemic had many retailers switching to cashless transactions, and lockdowns further restricted access to ATMs that were housed inside banks and other businesses.

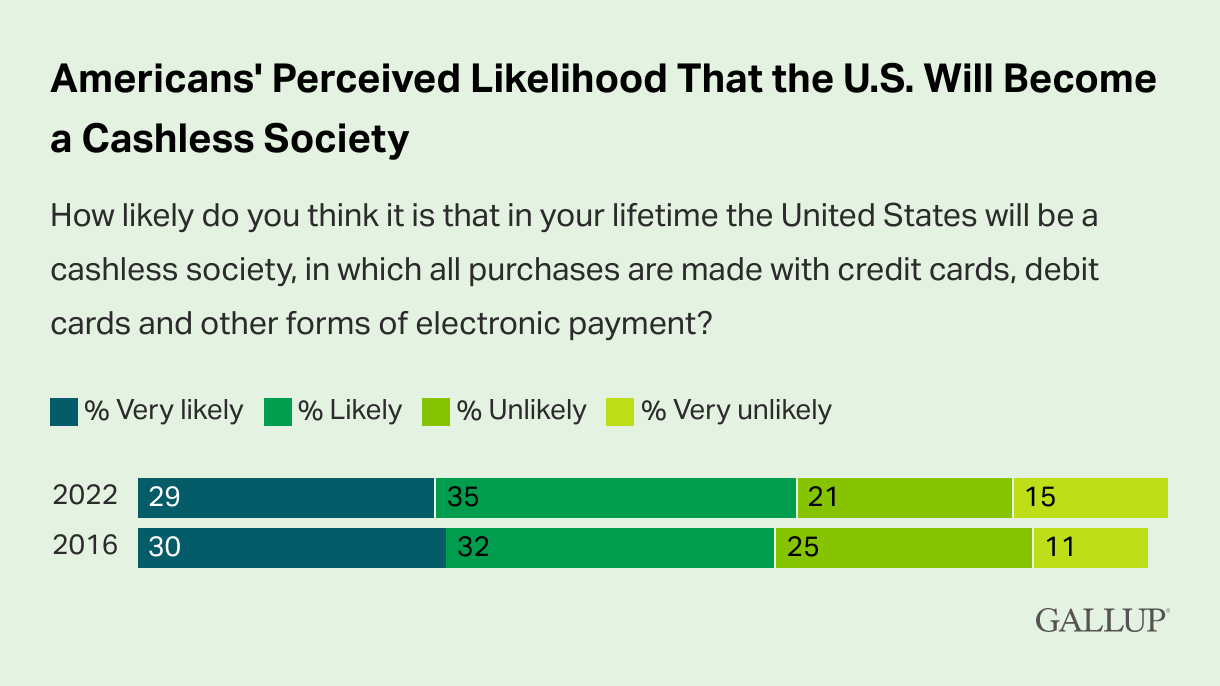

Record-high fees, and a 90% increase in ATM-related financial crime from 2022, have made ATM usage less attractive. In a recent Gallup poll, 64% of Americans said they believe it is likely the United States will be cashless in their lifetime.

However, there are more than half a million ATMs currently in use in the United States, according to the ATMIA, a trade association for the ATM industry, and for many people, they remain a lifeline. According to Gallup, 22% of Americans with an annual household income of $40,000 or less use cash for all or most of their purchases, compared with 14% of those whose annual household income is between $40,000 and $99,999 and 5% of those whose income is $100,000 or more.

For many, ATMs are the main method of gaining access to that cash, whether at traditional banking branches, operated through a cooperative partnership like those for credit unions and located in convenience stores and elsewhere, or owned and operated by independent agents.

"ATMs are here to stay for a while but the number of transactions has been on a steady downswing, and that's actually been a driving force in pushing ATM fees higher," said Greg McBride, Chief Financial Analyst for Bankrate. "Banks give free access to their account holders, but it's non-account holders who have to pay the costs associated with maintaining these networks. As there are fewer transactions, those costs go up across the network, and non-customers bear the brunt of those fees."

Fees, which can be charged by both a customer's bank and their ATM of choice, can typically be avoided by staying inside the network. But that's not always possible, particularly in rural areas with limited banking options, or when using an independent ATM.

"The independent ATM space is very entrepreneurial," said Amy Zirkle, Senior Program Manager, Payments and Deposits, Office of Consumer Credit, Payments, & Deposits Markets at the Consumer Financial Protection Bureau (CFPB), a government agency. "It's reasonably easy to get into the ATM business but there are definitely challenges, and the transparency around those contracts are not well known."

"As banks pull out of rural areas or lose branches, that area is losing those ATMs, so someone is forced to use an ATM with questionable security, or fees," Zirkle said. "There have been some who argue that the fees associated with ATMs and the like may be another reason why people are drawn to an online-only bank, but there is the challenge of where do you get cash in that situation."

While the occasional ATM fee may be unavoidable, McBride advised against getting into a habit of paying fees at every withdrawal. That can be a sign of poor financial hygiene and is easily corrected.

"If you have an account that doesn't meet your needs, with regards to ATM fees, or it limits the number of ATM transactions you can make and it doesn't fit your lifestyle, you don't have to switch banks, but you can switch accounts to one that fits your needs," McBride said.

Journalists can incorporate reporting about ATM and associated fees into articles on budgeting, inflation, digital currencies, online financial tools, and more.

Additional Resources

Molly McCluskey is an award-winning journalist who has written for The Atlantic, The Washington Post, Rolling Stone, New York Magazine, National Geographic and more. View her work and get in touch via mollyemccluskey.com.

Finance 411 is a bi-monthly feature, presented by RTDNA and the National Endowment for Financial Education.