Local TV News, OTT and NextGen TV in 2022

This is the third year for the RTDNA/Newhouse School at Syracuse University Survey question: What, if anything, are you doing with OTT? It’s the second year that we’ve asked what, if anything, stations are doing with NextGen TV.

OTT stands for over the top (sometimes called internet television or online television), and while there’s some disagreement over exactly what qualifies as over the top, it generally refers to program material that consumers receive via streaming rather than via cable, satellite or telco. Most commonly, that content has arrived at consumers via Hulu, Roku or YouTube, but more and more companies are setting up their own services: fuboTV, PlayStation Vue, Netflix, Amazon Prime, Sling TV, NBC Peacock, Paramount+ (CBS), Apple TV+, Android TV, TVision, Tubi, FilmRise, HBO Max, Philo, DirecTV, Premion, Sinclair’s STIRR and CompulseOTT, CBSN, NBCVU Local and LX, Disney+, and the list goes on (and keeps growing).

NextGen TV, or ATSC 3.0, is the third generation of digital TV technology. It involves enhanced picture and sound quality and, combined with an internet connection, allows for a level of interactivity and addressability that hasn’t been possible before. In order to get NextGen TV, consumers must buy a NextGen-enabled TV. ATSC 3.0 is not compatible with earlier digital TVs and consumers will need an antenna because it’s not available (yet) via cable or satellite. At the time of this writing, NextGen TV is operating in 45 markets and should be operational in another 33 by the time this is published.

OTT

Doing “something” with OTT continues to edge up. Stations doing “something” moved from 53.8% two years ago to 55.2% last year to 58% this time around. Not exactly setting the world on fire, but clearly moving up.

On the other hand, stations in the top 25 markets went from 72% doing something last year to 65% this year. The smallest markets also went down in percentage while markets 26 through 150 all went up — if sometimes modestly. The smallest markets and stations with the smallest staffs are the least likely to be involved with OTT.

As was the case a year ago, Fox affiliates and other commercial stations were all less likely to be involved with OTT than legacy affiliates. No non-commercial station in the Survey reported doing anything with OTT.

So what are stations doing with OTT this year? The most common answers involve streaming (which, of course, is what OTT is), particularly news, newscasts, news on demand and breaking news.

Several stations have or are setting up 24/5 or 24/7 news content. More and more have set up OTT desks to operate/oversee the OTT operation.

What stations are doing varies from just getting started to having multiple 24 hour per day operations:

- 18 hours/day live from newsroom (4 years running)

- 6 OTT exclusive programs, including daily newscast

- Breaking news, what’s trending segment and what’s happening segment; Friday night football overtime

- Built a new OTT Desk to allow us to go live with breaking news and severe weather updates much faster than before

- Fire TV, Apple TV, Roku, Hulu, YouTube, AT&T (DirecTV stream)

- Live streams, unique content, newscast replay

- Livestream special events, talkbacks for special stories, cross-posting from our national OTT desk partners within Gray

- Streaming live/latest newscasts, creating digital-only content shelves

- There is some daily content on our OTT channel including newscasts and live events.

- We are streaming our newscast via various OTT platforms and looking to use our OTT Desk for in-between casts content daily in 2022.

- We created an OTT Anchor Desk and have laced it into Gray TV's Local News Live feed as well. We can anchor breaking news 24/7 off the OTT desk as well as support Gray TV's OTT efforts to create an online 24/7 local news LIVE channel.

- We do daily news/feature/weather/sports segments on our Digital Desk.

- We have a 24/7 Streaming channel as well as a Breaking News channel.

- We have an OTT setup and are working on cross-training and figuring out what content works best with it.

- We're on every streaming platform possible with a robust app that includes live newscasts, multiple live streams per day and video on demand.

OTT is clearly still a work in progress, but the answers to the question on what stations are doing and why continue to be more and more specific and extensive.

OTT is Allowing Newsrooms To...

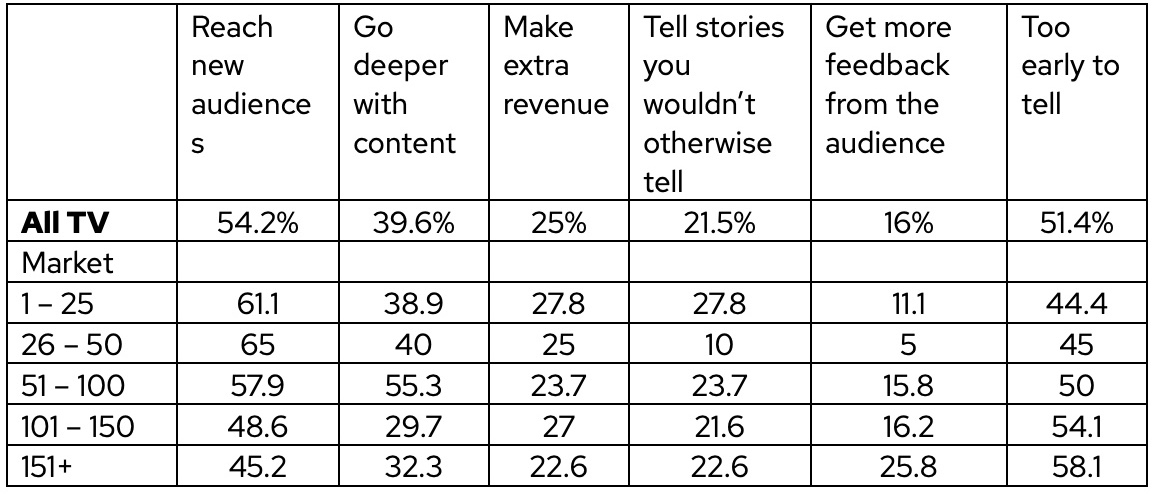

The trends involved in the answers in this table really tell a lot of what’s going on with OTT. “Reach new audiences” remained in first place although the percentage is down three and a half points. “Go deeper with content” jumped almost 10 points, remaining in second place. “Make extra revenue” edged up by 0.3. “Tell stories you wouldn’t otherwise tell” also jumped by about 10 points but stayed in fourth place. “Get more feedback from the audience” doubled to 16%. As it becomes easier to tell what OTT is doing, the “too early to tell” category should go down — and it did by 6 points. Still very high.

The order doesn’t change much when you look at the numbers by staff size, affiliation or geography, but there are some interesting differences.

“Reach new audiences” drops as staff size declines. “Tell stories you wouldn’t otherwise tell” is much higher in the West than any other region. “Get more feedback” from the audience goes up as staff size gets smaller; Fox stations are much lower than all the others in audience feedback and the Northeast and Midwest lag well behind the South and West. The bigger the market and the bigger the staff, the more likely that “make extra revenue” is part of the picture.

NextGen TV … ATSC 3.0

This is just the second year for the question, “What, if anything, are you doing with NextGen TV (ATSC 3.0)?” Some TV companies (especially Sinclair and Nexstar) see this as critical to the future of local TV; others are not as sure. The key idea behind NextGen TV, or ATSC 3.0, is a merging of television and internet technologies. Through changes in compression, it allows a higher quality (4K) picture and better audio. But the reason TV companies are particularly interested in NextGen is addressability. Because of the internet connection, it allows stations to tailor commercials to specific zip codes or even homes.

That could enhance station profits. But consumers must play their part in this. NextGen TV is not compatible with most of today’s TVs, so consumers must care enough to spend more money for a NextGen TV. You need a special tuner, and right now, you can only get real NextGen TV over the air, which means an antenna. And being able to watch in 4K only works if someone’s producing 4K material, and there isn’t much of that yet.

More and more TV markets are starting to feed at least some material for NextGen, but we’re a long way from knowing if average (or even enough high-end) consumers will care.

Overall, just 11% of TV news directors reported doing “something” with NextGen TV. That’s actually down from last year’s 12.3%. The number peaks at 41.2% in the top 25 markets. That’s up 16 points from last year, but no other market size passed 15%.

The specific answers to “what stations are doing” look a lot like last year. They weren’t very specific – and there weren’t very many of them:

- Good question for engineers

- I know we're doing something. I'm just not sure what at this point. Waiting for an update from engineering

- Experimental transmitter

- I hesitate to say nothing — instead, I'll say I don't know

- Planning for ATSC 3.0 launch in 2022

- Starting soon

- We use it.

- We're on it.

That’s actually about half of all the comments — and easily the most specific of the group. Last year we concluded, “More next year (probably).” Okay, we’ll say it again.

Bob Papper is Adjunct Professor of Broadcast and Digital Journalism at Syracuse University and has worked extensively in radio and TV news.

Keren Henderson is Associate Professor of Broadcast and Digital Journalism at Syracuse University. This research was supported by the S. I. Newhouse School of Public Communications at Syracuse University and the Radio Television Digital News Association.

About the Survey

The RTDNA/Newhouse School at Syracuse University Survey was conducted in the fourth quarter of 2021 among all 1,780 operating, non-satellite television stations and a random sample of 3,379 radio stations. Valid responses came from as many as 1,336 television stations (75.1%) and 765 radio news directors and general managers representing 2,310 radio stations. Some data sets (e.g. the number of TV stations originating local news, getting it from others and women TV news directors) are based on a complete census and are not projected from a smaller sample.